Listen to "Great Depression New Deal Module Three - The Great Stock Market Crash" on Spreaker. *******

The links below will help you with translating tools between English and Spanish.

1. Audio of a words in both English and Spanish. Will also translate phrases.

2. Google Search - Espana: The word can be typed in English, and the search finds results in Spanish, including images

3. Also Google Arabic is available.

2. Google Search - Espana: The word can be typed in English, and the search finds results in Spanish, including images

3. Also Google Arabic is available.

Module 3 - Stock Market Crash

The red line represents (stands for) the value of companies (share of stock).

What does it mean that the red line drops off of the chart and through the floor?

Would that be a good or bad thing? Why?

Black Tuesday 10/29 - The Stock Market Crash

Look at the newspaper headline - What did the panic cause, and what did they mean by wrecked?

This video will let you hear the story of 'The Great Crash" you are about to read about

All of the pressures on banking and business you just learned about in Module Two started to cause BIG problems in early 1929. There was a mini crash (BIG drop in value) in the STOCK MARKET (where shares of stock are sold - pieces of a company) in March of 1929, but the values quickly went back up. Values of stock kind of bounced up and down all through 1929, until it got to October.

This is a picture from the 1920s-1930s of the floor of the Stock Exchange where they actually traded stocks.

Think of the word PANIC. That is what happened. Panic is a word that describes a very strong, fear that spreads from person to person like a sickness.

He is panicking. See the effect it is having?

Can this reaction spread?

Can this reaction spread?

You may have seen a friend acting very goofy in a loud way. They bounce around the room or the hallway. This is frenzy. Panic is far more serious than frenzy. One week in October 1929, there was a true panic, and many rich people became poor people in one single day. This is what happened.

Here you see people who are still wearing nice clothes outside in the cold (see the jackets and steaming soup). I am guessing they used to be rich, but now they depend on other people for free food

***

This video shows an actual breadline, and tells some about the time.

The Previous Thursday - 10/24

On Thursday, October 24, 1929, people saw danger signs in the value of stocks. They were afraid the values would FALL a lot. That means the value of their investments would drop A LOT. They began to be afraid they would lose a lot of money.

It was kind of like this stack of money that is burning.

It would be gone soon.

In order to try to make it so they did not lose much money many people began to sell. This made the prices drop even more (The more of a stock that is available to buy, the lower the price is pushed.)

It works the same way with other things people buy, like the latest and best phone. If you own one of only ten of them the supply is low, and you could probably ask a buyer for any amount of money, since there aren't many phones they can get. BUT if you owned one, and there were 7 million others for sale, you cannot charge as much, since buyers have other choices to buy from, who might charge less than you.

It works the same way with other things people buy, like the latest and best phone. If you own one of only ten of them the supply is low, and you could probably ask a buyer for any amount of money, since there aren't many phones they can get. BUT if you owned one, and there were 7 million others for sale, you cannot charge as much, since buyers have other choices to buy from, who might charge less than you.

The demand for stocks dropped because everyone wanted to sell, and few wanted to buy. The supply of stock was BIG. This made the price fall.

In fact on that day there were 12,894,650 shares sold. That is 4 TIMES more than had ever been sold before. The previous (click here to SEE previous)one day record of 3,875,910 shares. There was so much excitement that police had to be called in to control the crowds growing in the street outside where the stocks were sold.

They are in the street panicking that their stock money is gone.

What do you think the police officer is saying to them?

In the middle of the day the stocks of some companies had lost almost half (½ or 50% ) of what they were worth (value) . EXAMPLE: The stock of a store like J.C. Penny’s started the day at $83. By lunch time it had FALLEN to $50 for each share. By the end of the day it had climbed all the way back up to being worth $74 for each share. Most, but not all the way back up. People lost money, but not TOO much. However, all was NOT well.

Not much happened the next day, Friday the 25th, because people were really nervous (click to see what nervous might look like). AND because they THOUGHT banks had saved the day. They were wrong.

Headline from that morning, October 25th, 1929

Monday- 10/28

On Monday, October 28, 1929 the amount sold was huge again. It was over 9,250,000 shares sold. Once again people lost a lot of money. Unlike Thursday, there was no big recovery (rise) in values of stocks. This set the stage (created the chance it would happen) for the next day, which would go down in history as “Black Tuesday.”

Black Tuesday - October 29th

At the start of trading on Tuesday many people started trying to sell their stocks. They figured (thought) it was better to sell at a loss now instead of waiting for the value of their stocks to drop even lower. In fact on this day a new record was set as to the number of stocks sold in one day. It was 16,410,030 shares.

The problem now was that so many people were trying to sell the stocks that there was no one who wanted to actually buy them. Think of it, if you have something to sell, and nobody wants to buy it, how much is it worth??? Right, NOTHING. People now started to panic.

This is a picture from that day with people outside the building where they traded stocks. They were VERY worried

The banks that had invested the savings money of their customers in the stock market started calling the people who had borrowed that money from them to buy stocks. (They call this a MARGIN CALL. A Margin call is when you have to pay all the loan back immediately.) They wanted them to pay the loan back RIGHT AWAY. ALL OF IT.

*

People were not expecting to have to pay it all back at once.

Then---What if they did not HAVE the money???

Then---What if they did not HAVE the money???

This caused a problem as the people did not have that money to pay back, and there was no way they could get it. Even if they could sell the stock it was now worth LESS than what they had borrowed.

Chart showing Margin Buying problem

Do you get this? You LOST $8,000 on a $10,000 stock purchase. YOU thought the value would go up, but it went down instead. AND...you are lucky. at least you got $2,000 for the stock. BUT...You still owed the back $7,000!!!

Not good!!!

All the money those people did have was invested in stocks, and now that was ALL gone. Many stocks were now worth NOTHING!!! When people found their hard earned savings was gone, the panic spread.

*

*

Short video of the Great Crash

Hear about it in another way

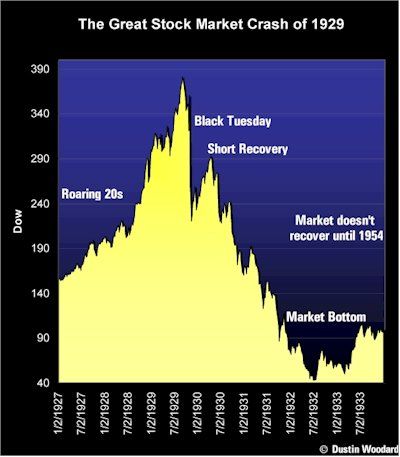

The Stock Market had CRASHED. As bad as the “Black Tuesday” crash was, it would get worse. Much worse. By the time it stopped crashing and started a slow climb back up, 3 years later in 1932, it had lost 89 % of the value it had in July of 1929.

It went like this. On the day of the Great Crash it (average value of stocks) dropped from about $388 to about $201. That is a drop of 48% (almost half). Six months later (April of 1930) it had gotten all the way back up to a $312 average.

Then it started dropping again, largely because the money supply in the country was drying up. This supply was necessary to make buying and selling of everything happen. When it stopped dropping in July of 1932 it was all the way down to $42.

Then it started dropping again, largely because the money supply in the country was drying up. This supply was necessary to make buying and selling of everything happen. When it stopped dropping in July of 1932 it was all the way down to $42.

This means that from the Great Crash in 1929, when the average value of a stock was $388 per share until the time it stopped dropping in 1932 at about $42 per share, the stock market average had lost $346 in value which added up to 89% of its value. Kind of like you having 100 dollars, and it starts to just disappear. When it stops disappearing you only have $11 left.

Think of it like this: You buy a (cell phone, video game, whatever) from your friend for $100 because you think it will increase in value, and you can soon sell it to someone for a LOT more money.

However, it starts dropping in value. Oh, it shoots up a bit soon after it started dropping, but then starts dropping in value again. When it finally stops dropping in value it is worth only $11. So it dropped all the way from $100 of value to $11 of value.

People were going to suffer

Now that was WAAAAY back in 1929.

What should we do when we see people with problems today?

No---Not give them cash. What else???

What should we do when we see people with problems today?

No---Not give them cash. What else???